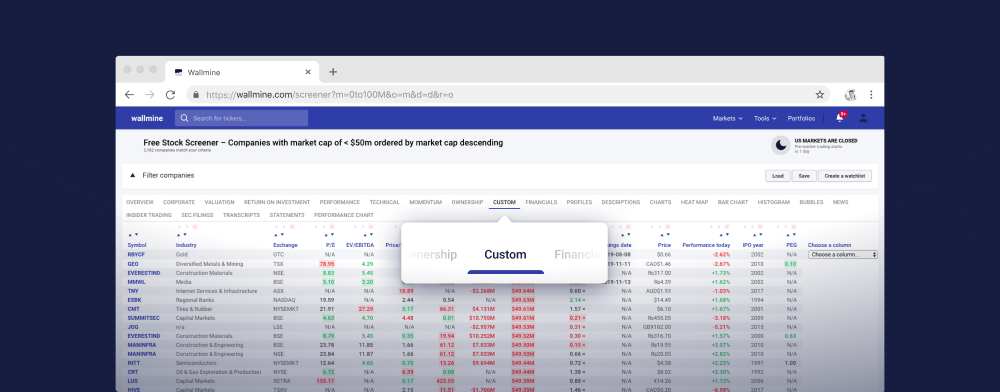

Free Stock Screener

Load Save Create a watchlist Help

TOSBF

| Market cap | $13.83B |

|---|---|

| Enterprise value | $14.42B |

| Revenue | ¥3.404T |

|---|---|

| EBITDA | ¥151.640B |

| Income | ¥235.517B |

| Revenue Q/Q | 4.40% |

| Revenue Y/Y | N/A |

| P/E | 7.27 |

|---|---|

| Forward P/E | 14.03 |

| EV/Sales | 0.58 |

| EV/EBITDA | 12.91 |

| EV/EBIT | 73.61 |

| PEG | N/A |

| Price/Sales | 0.55 |

| P/FCF | N/A |

| Price/Book | 1.33 |

| Book/Share | 20.89 |

| Cash/Share | 1,118.65 |

| FCF yield | -1.43% |

| Volume | 40.000 / 9.300B |

|---|---|

| Relative vol. | 0.00 × |

| EPS | 3.83 |

|---|---|

| EPS Q/Q | N/A |

| Est. EPS Q/Q | N/A |

| Profit margin | 5.75% |

|---|---|

| Oper. margin | 0.78% |

| Gross margin | 28.98% |

| EBIT margin | 0.78% |

| EBITDA margin | 4.45% |

| Ret. on assets | 6.38% |

|---|---|

| Ret. on equity | 19.74% |

| ROIC | 2.20% |

| ROCE | 1.23% |

| Debt/Equity | 1.96 |

|---|---|

| Net debt/EBITDA | -1.28 |

| Current ratio | 1.41 |

| Quick ratio | 0.98 |

| Volatility | 114565693782240201.37% |

|---|---|

| Beta | 0.74 |

| RSI | 48.15 |

|---|

| Range | $27.81 – $27.81 |

|---|---|

| 52 weeks | $27.81 – $268,236,117,505,072,960.00 |

| SMA 50 | $33,529,516,139,980,379 -120,566,401,078,677,997.27% |

| SMA 200 | $53,647,224,086,914,606 -192,906,235,479,735,988.31% |

| Insider ownership | 4.73% |

|---|---|

| Inst. ownership | 55.87% |

| Shares outst. | 432.516M |

|---|---|

| Shares float | 362.356M 83.78% |

| Short % of float | N/A |

| Short ratio | N/A |

| Dividend | $0.00 |

|---|---|

| Dividend yield | 0.00% |

| Payout ratio | 0.00% |

| Payment date | N/A |

| Ex-dividend date | N/A |

| Earnings date | N/A |

| Market cap | $736.72M |

|---|---|

| Enterprise value | $755.09M |

| Revenue | HKD$330.420M |

|---|---|

| EBITDA | -HKD$13.15 |

| Income | -HKD$551.26 |

| Revenue Q/Q | -79.50% |

| Revenue Y/Y | -0.27% |

| P/E | N/A |

|---|---|

| Forward P/E | N/A |

| EV/Sales | 17.94 |

| EV/EBITDA | N/A |

| EV/EBIT | N/A |

| PEG | N/A |

| Price/Sales | 17.50 |

| P/FCF | 10.45 |

| Price/Book | 14.28 |

| Book/Share | 0.00 |

| Cash/Share | 0.00 |

| FCF yield | N/A |

| Volume | 1.508B / 1.587B |

|---|---|

| Relative vol. | 0.95 × |

| EPS | 0.00 |

|---|---|

| EPS Q/Q | N/A |

| Est. EPS Q/Q | N/A |

| Profit margin | -166.83% |

|---|---|

| Oper. margin | -79.14% |

| Gross margin | 17.67% |

| EBIT margin | N/A |

| EBITDA margin | -3.98% |

| Ret. on assets | -43.21% |

|---|---|

| Ret. on equity | -71.28% |

| ROIC | N/A |

| ROCE | 0.00% |

| Debt/Equity | 1.14 |

|---|---|

| Net debt/EBITDA | -21.96 |

| Current ratio | 1.53 |

| Quick ratio | 1.46 |

| Volatility | 17.48% |

|---|---|

| Beta | 0.55 |

| RSI | 20.77 |

|---|

| Insider ownership | 50.26% |

|---|---|

| Inst. ownership | 0.04% |

| Shares outst. | 6.725B |

|---|---|

| Shares float | 3.345B 49.74% |

| Short % of float | N/A |

| Short ratio | N/A |

| Dividend | HKD$0.00 |

|---|---|

| Dividend yield | 0.00% |

| Payout ratio | 0.00% |

| Payment date | N/A |

| Ex-dividend date | N/A |

| Earnings date | N/A |

0HDH

| Market cap | N/A |

|---|---|

| Enterprise value | N/A |

| Revenue | kr2.899B |

|---|---|

| EBITDA | kr2.265B |

| Income | kr3.677B |

| Revenue Q/Q | 12.35% |

| Revenue Y/Y | N/A |

| P/E | 4.14 |

|---|---|

| Forward P/E | N/A |

| EV/Sales | N/A |

| EV/EBITDA | N/A |

| EV/EBIT | N/A |

| PEG | N/A |

| Price/Sales | N/A |

| P/FCF | N/A |

| Price/Book | 0.69 |

| Book/Share | 50.67 |

| Cash/Share | 0.05 |

| FCF yield | N/A |

| Volume | 1.108B / 1.108B |

|---|---|

| Relative vol. | 1.00 × |

| EPS | 8.43 |

|---|---|

| EPS Q/Q | N/A |

| Est. EPS Q/Q | N/A |

| Profit margin | 128.05% |

|---|---|

| Oper. margin | 78.16% |

| Gross margin | 82.33% |

| EBIT margin | 78.16% |

| EBITDA margin | 78.13% |

| Ret. on assets | 8.05% |

|---|---|

| Ret. on equity | 17.50% |

| ROIC | 4.47% |

| ROCE | 5.20% |

| Debt/Equity | 1.08 |

|---|---|

| Net debt/EBITDA | 34.59 |

| Current ratio | 0.15 |

| Quick ratio | 0.01 |

| Volatility | N/A |

|---|---|

| Beta | 0.43 |

| RSI | N/A |

|---|

| Insider ownership | 28.86% |

|---|---|

| Inst. ownership | 3.47% |

| Shares outst. | N/A |

|---|---|

| Shares float | 261.488M |

| Short % of float | N/A |

| Short ratio | N/A |

| Dividend | N/A |

|---|---|

| Dividend yield | N/A |

| Payout ratio | N/A |

| Payment date | N/A |

| Ex-dividend date | N/A |

| Earnings date | N/A |

| Market cap | $294.24M |

|---|---|

| Enterprise value | $3.01B |

| Revenue | $3.676B |

|---|---|

| EBITDA | $388.200M |

| Income | $97.400M |

| Revenue Q/Q | -3.78% |

| Revenue Y/Y | -22.83% |

| P/E | 3.02 |

|---|---|

| Forward P/E | 36.23 |

| EV/Sales | 0.82 |

| EV/EBITDA | 7.76 |

| EV/EBIT | N/A |

| PEG | N/A |

| Price/Sales | 0.08 |

| P/FCF | 0.31 |

| Price/Book | 0.19 |

| Book/Share | 11.93 |

| Cash/Share | 5.74 |

| FCF yield | 317.64% |

| Volume | 1.103B / 1.103B |

|---|---|

| Relative vol. | 1.00 × |

| EPS | 0.75 |

|---|---|

| EPS Q/Q | N/A |

| Est. EPS Q/Q | N/A |

| Profit margin | 0.85% |

|---|---|

| Oper. margin | 18.30% |

| Gross margin | 37.16% |

| EBIT margin | N/A |

| EBITDA margin | 10.56% |

| Ret. on assets | 0.98% |

|---|---|

| Ret. on equity | 6.46% |

| ROIC | 4.89% |

| ROCE | 0.00% |

| Debt/Equity | 5.43 |

|---|---|

| Net debt/EBITDA | 8.66 |

| Current ratio | 0.81 |

| Quick ratio | 0.73 |

| Volatility | 87.44% |

|---|---|

| Beta | 3.70 |

| RSI | 13.88 |

|---|

| Insider ownership | 4.04% |

|---|---|

| Inst. ownership | 42.22% |

| Shares outst. | 925.533M |

|---|---|

| Shares float | 922.994M 99.73% |

| Short % of float | N/A |

| Short ratio | N/A |

| Dividend | GBX0.00 |

|---|---|

| Dividend yield | 0.00% |

| Payout ratio | 0.00% |

| Payment date | N/A |

| Ex-dividend date | N/A |

| Earnings date | N/A |

| Market cap | $285.49M |

|---|---|

| Enterprise value | $285.50M |

| Revenue | $0.00 |

|---|---|

| EBITDA | N/A |

| Income | -$25.05 |

| Revenue Q/Q | N/A |

| Revenue Y/Y | N/A |

| P/E | N/A |

|---|---|

| Forward P/E | N/A |

| EV/Sales | N/A |

| EV/EBITDA | N/A |

| EV/EBIT | N/A |

| PEG | N/A |

| Price/Sales | N/A |

| P/FCF | N/A |

| Price/Book | 57.10 |

| Book/Share | 0.12 |

| Cash/Share | 0.09 |

| FCF yield | N/A |

| Volume | 520.578k / 641.855M |

|---|---|

| Relative vol. | 0.00 × |

| EPS | N/A |

|---|---|

| EPS Q/Q | N/A |

| Est. EPS Q/Q | N/A |

| Profit margin | 0.00% |

|---|---|

| Oper. margin | 0.00% |

| Gross margin | N/A |

| EBIT margin | N/A |

| EBITDA margin | N/A |

| Ret. on assets | -10.83% |

|---|---|

| Ret. on equity | -500.99% |

| ROIC | 0.00% |

| ROCE | -1.61% |

| Debt/Equity | 45.32 |

|---|---|

| Net debt/EBITDA | N/A |

| Current ratio | 0.29 |

| Quick ratio | 0.29 |

| Volatility | 14.45% |

|---|---|

| Beta | N/A |

| RSI | 37.30 |

|---|

| Insider ownership | 0.00% |

|---|---|

| Inst. ownership | 71.69% |

| Shares outst. | 23.000M |

|---|---|

| Shares float | 1.773M 7.71% |

| Short % of float | 4.13% |

| Short ratio | 3.62 |

| Dividend | N/A |

|---|---|

| Dividend yield | N/A |

| Payout ratio | N/A |

| Payment date | N/A |

| Ex-dividend date | N/A |

| Earnings date | N/A |

HUTMF

| Market cap | $490.87M |

|---|---|

| Enterprise value | $551.17M |

| Revenue | CAD$147.560M |

|---|---|

| EBITDA | CAD$14.241M |

| Income | CAD$185.210M |

| Revenue Q/Q | 45.54% |

| Revenue Y/Y | 62.64% |

| P/E | 3.48 |

|---|---|

| Forward P/E | N/A |

| EV/Sales | 4.90 |

| EV/EBITDA | 50.76 |

| EV/EBIT | 112.55 |

| PEG | N/A |

| Price/Sales | 4.36 |

| P/FCF | N/A |

| Price/Book | 1.32 |

| Book/Share | 5.00 |

| Cash/Share | 0.02 |

| FCF yield | 1.76% |

| Volume | 3.737M / 620.370M |

|---|---|

| Relative vol. | 0.01 × |

| EPS | 1.90 |

|---|---|

| EPS Q/Q | N/A |

| Est. EPS Q/Q | N/A |

| Profit margin | 10.25% |

|---|---|

| Oper. margin | 141.82% |

| Gross margin | 43.40% |

| EBIT margin | 10.36% |

| EBITDA margin | 9.65% |

| Ret. on assets | -25.08% |

|---|---|

| Ret. on equity | -41.86% |

| ROIC | -30.81% |

| ROCE | 0.00% |

| Debt/Equity | 0.52 |

|---|---|

| Net debt/EBITDA | 12.02 |

| Current ratio | 1.68 |

| Quick ratio | 0.11 |

| Volatility | 8.49% |

|---|---|

| Beta | 2.58 |

| RSI | 67.41 |

|---|

| Insider ownership | 18.16% |

|---|---|

| Inst. ownership | 14.55% |

| Shares outst. | 112.232M |

|---|---|

| Shares float | 97.291M 86.69% |

| Short % of float | N/A |

| Short ratio | N/A |

| Dividend | N/A |

|---|---|

| Dividend yield | N/A |

| Payout ratio | N/A |

| Payment date | N/A |

| Ex-dividend date | N/A |

| Earnings date | N/A |

| Market cap | $3.01B |

|---|---|

| Enterprise value | $34.19B |

| Revenue | ₨409.722B |

|---|---|

| EBITDA | ₨184.766B |

| Income | -₨286.86 |

| Revenue Q/Q | 12.87% |

| Revenue Y/Y | 4.94% |

| P/E | N/A |

|---|---|

| Forward P/E | -0.20 |

| EV/Sales | 6.66 |

| EV/EBITDA | 14.77 |

| EV/EBIT | N/A |

| PEG | N/A |

| Price/Sales | 0.59 |

| P/FCF | N/A |

| Price/Book | -0.67 |

| Book/Share | -20.27 |

| Cash/Share | 0.48 |

| FCF yield | N/A |

| Volume | 407.922M / 507.969M |

|---|---|

| Relative vol. | 0.80 × |

| EPS | -8.13 |

|---|---|

| EPS Q/Q | -13.03% |

| Est. EPS Q/Q | -15.32% |

| Profit margin | -73.37% |

|---|---|

| Oper. margin | -15.36% |

| Gross margin | 45.65% |

| EBIT margin | -15.36% |

| EBITDA margin | 45.10% |

| Ret. on assets | -1.89% |

|---|---|

| Ret. on equity | 44.08% |

| ROIC | -3.84% |

| ROCE | -4.03% |

| Debt/Equity | -4.13 |

|---|---|

| Net debt/EBITDA | N/A |

| Current ratio | 0.24 |

| Quick ratio | 0.24 |

| Volatility | 5.08% |

|---|---|

| Beta | 0.64 |

| RSI | 27.94 |

|---|

| Insider ownership | 75.00% |

|---|---|

| Inst. ownership | 3.12% |

| Shares outst. | 28.735B |

|---|---|

| Shares float | 7.833B 27.26% |

| Short % of float | N/A |

| Short ratio | N/A |

| Dividend | ₨0.00 |

|---|---|

| Dividend yield | 0.00% |

| Payout ratio | 0.00% |

| Payment date | N/A |

| Ex-dividend date | N/A |

| Earnings date | N/A |

| Market cap | N/A |

|---|---|

| Enterprise value | N/A |

| Revenue | N/A |

|---|---|

| EBITDA | N/A |

| Income | N/A |

| Revenue Q/Q | N/A |

| Revenue Y/Y | N/A |

| P/E | N/A |

|---|---|

| Forward P/E | N/A |

| EV/Sales | N/A |

| EV/EBITDA | N/A |

| EV/EBIT | N/A |

| PEG | N/A |

| Price/Sales | N/A |

| P/FCF | N/A |

| Price/Book | N/A |

| Book/Share | N/A |

| Cash/Share | N/A |

| FCF yield | N/A |

| Volume | 212.178M / 490.290M |

|---|---|

| Relative vol. | 0.43 × |

| EPS | N/A |

|---|---|

| EPS Q/Q | N/A |

| Est. EPS Q/Q | N/A |

| Profit margin | 0.00% |

|---|---|

| Oper. margin | 0.00% |

| Gross margin | N/A |

| EBIT margin | N/A |

| EBITDA margin | N/A |

| Ret. on assets | N/A |

|---|---|

| Ret. on equity | N/A |

| ROIC | N/A |

| ROCE | N/A |

| Debt/Equity | N/A |

|---|---|

| Net debt/EBITDA | N/A |

| Current ratio | N/A |

| Quick ratio | N/A |

| Volatility | 2.37% |

|---|---|

| Beta | N/A |

| RSI | 52.30 |

|---|

| Insider ownership | 0.00% |

|---|---|

| Inst. ownership | 0.12% |

| Shares outst. | N/A |

|---|---|

| Shares float | N/A |

| Short % of float | N/A |

| Short ratio | N/A |

| Dividend | N/A |

|---|---|

| Dividend yield | N/A |

| Payout ratio | N/A |

| Payment date | N/A |

| Ex-dividend date | N/A |

| Earnings date | N/A |

| Market cap | $5.31M |

|---|---|

| Enterprise value | $3.71M |

| Revenue | AUD$1.850M |

|---|---|

| EBITDA | -AUD$576.88 |

| Income | -AUD$2.45 |

| Revenue Q/Q | -42.95% |

| Revenue Y/Y | -7.59% |

| P/E | N/A |

|---|---|

| Forward P/E | 5.00 |

| EV/Sales | 2.89 |

| EV/EBITDA | N/A |

| EV/EBIT | N/A |

| PEG | N/A |

| Price/Sales | 4.14 |

| P/FCF | N/A |

| Price/Book | 1.05 |

| Book/Share | 0.04 |

| Cash/Share | 0.00 |

| FCF yield | -21.34% |

| Volume | 72.998M / 445.284M |

|---|---|

| Relative vol. | 0.16 × |

| EPS | -0.01 |

|---|---|

| EPS Q/Q | N/A |

| Est. EPS Q/Q | N/A |

| Profit margin | -94.67% |

|---|---|

| Oper. margin | -131.46% |

| Gross margin | 30.00% |

| EBIT margin | N/A |

| EBITDA margin | -31.18% |

| Ret. on assets | -28.00% |

|---|---|

| Ret. on equity | -33.90% |

| ROIC | -17.13% |

| ROCE | 0.00% |

| Debt/Equity | 0.19 |

|---|---|

| Net debt/EBITDA | N/A |

| Current ratio | 1.00 |

| Quick ratio | 2.76 |

| Volatility | 23.64% |

|---|---|

| Beta | 1.95 |

| RSI | 43.32 |

|---|

| Insider ownership | 5.36% |

|---|---|

| Inst. ownership | 7.62% |

| Shares outst. | 6.363B |

|---|---|

| Shares float | 5.083B 79.88% |

| Short % of float | N/A |

| Short ratio | N/A |

| Dividend | N/A |

|---|---|

| Dividend yield | N/A |

| Payout ratio | N/A |

| Payment date | N/A |

| Ex-dividend date | N/A |

| Earnings date | N/A |

| Market cap | $3.11M |

|---|---|

| Enterprise value | $4.85M |

| Revenue | $5.424M |

|---|---|

| EBITDA | -$17.85 |

| Income | -$27.80 |

| Revenue Q/Q | 12,462.16% |

| Revenue Y/Y | N/A |

| P/E | 0.00 |

|---|---|

| Forward P/E | 7.75 |

| EV/Sales | 0.89 |

| EV/EBITDA | N/A |

| EV/EBIT | N/A |

| PEG | N/A |

| Price/Sales | 0.57 |

| P/FCF | N/A |

| Price/Book | 0.67 |

| Book/Share | 1.94 |

| Cash/Share | 0.44 |

| FCF yield | -583.23% |

| Volume | 368.342k / 421.489M |

|---|---|

| Relative vol. | 0.00 × |

| EPS | 958.61 |

|---|---|

| EPS Q/Q | -53.85% |

| Est. EPS Q/Q | -22.22% |

| Profit margin | -18,943.79% |

|---|---|

| Oper. margin | -348.64% |

| Gross margin | -479.08% |

| EBIT margin | -293.31% |

| EBITDA margin | -329.17% |

| Ret. on assets | -187.30% |

|---|---|

| Ret. on equity | -348.19% |

| ROIC | -242.81% |

| ROCE | -155.12% |

| Debt/Equity | 1.04 |

|---|---|

| Net debt/EBITDA | 0.06 |

| Current ratio | 1.60 |

| Quick ratio | 1.60 |

| Volatility | 30.80% |

|---|---|

| Beta | 0.92 |

| RSI | 33.52 |

|---|

| Insider ownership | 62.93% |

|---|---|

| Inst. ownership | 22.88% |

| Shares outst. | 20.270M |

|---|---|

| Shares float | 17.615M 86.90% |

| Short % of float | 4.20% |

| Short ratio | 1.26 |

| Dividend | N/A |

|---|---|

| Dividend yield | N/A |

| Payout ratio | N/A |

| Payment date | N/A |

| Ex-dividend date | N/A |

| Earnings date | N/A |