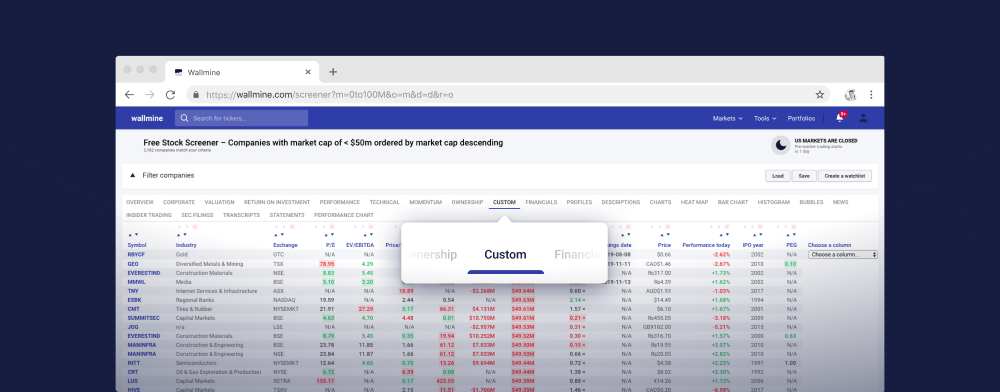

Free Stock Screener

Load Save Create a watchlist Help| Symbol | Ret. on assets | Ret. on equity | ROIC | Debt/Equity | Revenue Q/Q | Profit margin | Operating margin | Gross margin | ROCE | RPE | Performance today |

|---|---|---|---|---|---|---|---|---|---|---|---|

| FORE | -0.22% | 0.20% | -0.32% | 0.09 | N/A | 0.00% | 0.00% | 12.95% | -1.65% | XOF26.563M | -3.06% |

| MOPF | N/A | N/A | N/A | N/A | N/A | 0.00% | 0.00% | N/A | N/A | N/A | +0.00% |

| PAGEIND | 28.07% | 63.40% | 28.67% | 0.94 | 167.43% | 13.81% | 20.10% | 55.18% | N/A | ₨2.301M | +3.11% |

| MTVW | 5.72% | 6.77% | N/A | 0.19 | 10.55% | 35.76% | 48.89% | 60.97% | 0.00% | £2.608M | +0.00% |

| DP4B | 25.77% | 61.45% | 29.67% | 0.60 | 52.14% | 29.04% | 38.07% | 38.93% | 42.93% | $760.600k | +3.09% |

| TBCG | 3.71% | 24.76% | 0.00% | 5.84 | N/A | 51.25% | 64.10% | 100.00% | 0.00% | GEL257.504k | +0.56% |

| BGEO | 5.51% | 38.00% | 0.00% | 5.33 | N/A | 76.86% | 66.32% | 97.44% | 0.00% | GEL257.367k | +1.60% |

| ABBOTINDIA | 13.43% | 28.76% | 16.07% | 0.46 | 6.55% | 14.49% | 18.41% | 43.19% | N/A | ₨11.711M | +0.84% |

| ABBOTINDIA | 15.90% | 32.77% | 18.82% | 0.50 | 12.88% | 16.24% | 21.53% | 45.77% | 38.34% | ₨14.402M | +0.66% |

| MNDI | -2.67% | -4.51% | 13.48% | 0.63 | -3.66% | -2.09% | 6.91% | 37.39% | 0.00% | €276.462k | +1.14% |

| GAW | 43.13% | 60.82% | 51.42% | 0.40 | 13.84% | 28.74% | 38.88% | 71.41% | 0.00% | £215.805k | +0.10% |

| BOSCHLTD | 5.50% | 12.22% | 6.11% | 0.44 | 25.48% | 10.47% | 9.98% | 37.30% | 12.22% | ₨4.277M | +2.60% |

| BOSCHLTD | 5.44% | 2.70% | 5.53% | 0.44 | -64.32% | 6.76% | 6.96% | 44.76% | N/A | ₨8.540M | +3.03% |

| FERG | 11.57% | 35.02% | 11.17% | 2.18 | 2.35% | 6.35% | 8.90% | 30.35% | 0.00% | $952.484k | -0.35% |

| PAGEIND | 20.89% | 23.07% | 24.83% | 0.85 | -65.89% | 11.65% | 10.65% | 54.49% | N/A | ₨1.285M | +3.39% |

| PGHL | 16.05% | 33.37% | 19.51% | 0.45 | 9.07% | 17.28% | 22.26% | 69.51% | N/A | ₨8.364M | -1.76% |

| BAJAJHLDNG | 0.41% | 10.25% | 0.93% | 0.08 | 25.31% | 724.74% | 68.04% | 98.54% | 0.66% | ₨289.239M | +0.83% |

| OFSS | 21.99% | 27.67% | 21.13% | 0.23 | 7.42% | 36.17% | 42.58% | 53.72% | 31.86% | ₨6.671M | +2.05% |

| OFSS | 20.12% | 24.95% | 19.47% | 0.22 | 4.87% | 30.08% | 44.55% | 56.14% | N/A | ₨6.168M | +1.91% |

| AZN | 6.38% | 16.78% | 2.98% | 1.58 | 13.33% | 13.00% | 21.93% | 82.45% | 0.00% | $591.252k | -0.86% |

| BATS | -11.62% | -25.76% | 5.20% | 1.24 | -8.19% | -52.66% | 41.89% | 82.07% | 0.00% | £481.597k | -0.82% |

| ASCL | -4.81% | -10.22% | 3.52% | 1.92 | -40.16% | -92.68% | 12.71% | 64.05% | 0.00% | £285.550k | +0.00% |

| NXT | 18.43% | 58.50% | 23.12% | 1.88 | 12.06% | 14.61% | 17.87% | 44.74% | 0.00% | £215.409k | +0.83% |

| CRH | 6.41% | 13.37% | 5.17% | 1.20 | 8.93% | 9.09% | 12.32% | 34.23% | 0.00% | $437.481k | +1.93% |

| DISAQ | 8.93% | 13.29% | 10.59% | 0.40 | -55.49% | 12.68% | 10.42% | 45.55% | N/A | N/A | -0.71% |

| MRF | 4.59% | 12.34% | 6.48% | 0.61 | 11.74% | 8.27% | 11.02% | 38.89% | 0.00% | ₨23.985M | +0.29% |

| MRF | 2.60% | 4.88% | N/A | 0.61 | 11.74% | 8.27% | 11.02% | 38.89% | 0.00% | ₨14.263M | +0.19% |

| DCC | 3.46% | 10.77% | 5.04% | 1.98 | -9.90% | 1.64% | 2.71% | 13.08% | 0.00% | £1.533M | +1.07% |

| RHIM | 3.91% | 13.42% | 8.68% | 2.56 | -0.34% | 4.61% | 8.53% | 24.00% | 0.00% | €297.158k | +0.48% |

| SKG | 4.38% | 10.37% | 7.22% | 1.27 | -49.13% | 6.27% | 10.98% | 31.32% | 0.00% | €246.391k | +0.00% |

| CBDG | -0.01% | 0.17% | -0.01% | 0.00 | -99.64% | 6,400.00% | -450.00% | -600.00% | -0.02% | €141.34 | -0.67% |

| FOUR | 43.09% | 78.95% | 29.50% | 0.77 | 5.03% | 8.01% | 10.50% | 28.92% | 0.00% | $1.187M | +1.03% |

| MAHSCOOTER | 0.48% | 0.85% | 0.68% | 0.08 | 15.51% | 73.51% | 88.11% | 95.87% | 0.77% | ₨18.083M | +0.99% |

| MAHSCOOTER | 0.61% | 1.10% | 1.81% | 0.00 | -91.82% | 84.22% | 85.57% | 96.19% | 1.09% | ₨8.841M | +0.56% |

| SANOFI | 11.98% | 18.22% | 12.58% | 0.33 | -5.00% | 13.49% | 20.02% | 55.10% | 22.40% | ₨9.050M | -0.09% |

| SANOFI | 17.01% | 31.52% | 17.48% | 0.38 | -8.30% | 31.94% | 22.33% | 55.24% | N/A | ₨11.122M | -0.19% |

| PGHH | 29.77% | 62.91% | 34.71% | 1.28 | -1.27% | 14.76% | 18.02% | 59.82% | N/A | ₨83.963M | +0.36% |

| SPX | 7.11% | 16.57% | 15.17% | 1.34 | -2.80% | 10.91% | 17.95% | 75.72% | 0.00% | £202.293k | +1.28% |

| BAJAJ-AUTO | 12.77% | 20.71% | 16.22% | 0.25 | 16.04% | 15.28% | 18.54% | 29.72% | 25.42% | ₨36.193M | +2.64% |

| BAJAJ-AUTO | 14.31% | 20.27% | 17.84% | 0.22 | -57.78% | 16.63% | 20.80% | 32.45% | N/A | ₨25.203M | +2.64% |

| NESTLEIND | 18.83% | 82.08% | 23.86% | 2.65 | 1.65% | 15.95% | 19.90% | 56.94% | 45.75% | ₨16.628M | -0.09% |

| NESTLEIND | 22.62% | 98.13% | 27.92% | 2.94 | 18.25% | 14.61% | 18.91% | 56.28% | N/A | ₨20.627M | -0.11% |

| BVXP | 65.53% | 73.73% | 50.37% | 0.10 | 13.22% | 65.29% | 79.12% | 93.53% | 0.00% | £1.133M | -1.90% |

| VSTIND | 17.91% | 42.67% | 20.74% | 0.77 | -19.38% | 24.54% | 30.29% | 51.50% | N/A | ₨14.626M | +1.59% |

| VSTIND | 15.50% | 34.21% | 18.55% | 0.48 | 26.65% | 27.18% | 30.58% | 56.10% | 36.99% | ₨16.509M | +1.91% |

| IMB | 7.93% | 35.47% | 5.61% | 3.44 | 1.23% | 12.88% | 17.58% | 36.95% | 0.00% | £600.066k | +0.33% |

| ULVR | 8.56% | 30.33% | 16.76% | 2.62 | 2.26% | 10.88% | 18.10% | 42.24% | 0.00% | €404.790k | -0.12% |

| HEROMOTOCO | 10.63% | 16.93% | 13.59% | 0.36 | -63.73% | 12.44% | 9.38% | 31.73% | N/A | N/A | +2.58% |

| BAYERCROP | 11.47% | 23.69% | 14.93% | 0.49 | 85.02% | 13.13% | 20.33% | 46.70% | N/A | ₨31.641M | +1.05% |

| BAYERCROP | 11.24% | 26.09% | 13.31% | 0.72 | 6.36% | 13.63% | 16.36% | 43.45% | 27.48% | ₨40.452M | +0.58% |